To see the items that your company has click on the Inventory Icon and click on Items List in the command centre. You will see the item, click on the white arrow beside the item and you will see the details. On the profile page you will see the name of the item and all the accounts for buying, selling and inventory.

Click on the Buying Tab and you can enter the cost of purchasing the item, the unit measure and the number of items per unit measure. If your company purchases these items for one supplier, these details can be entered on this page as well as the minimum level needed for restocking.

In the Selling Tab, you would enter the cost of selling the item, unit measure and number of items per selling measure. Make sure that the correct tax code is entered as well as ticking if you want to note the cost is GST inclusive. Click record when all details entered.

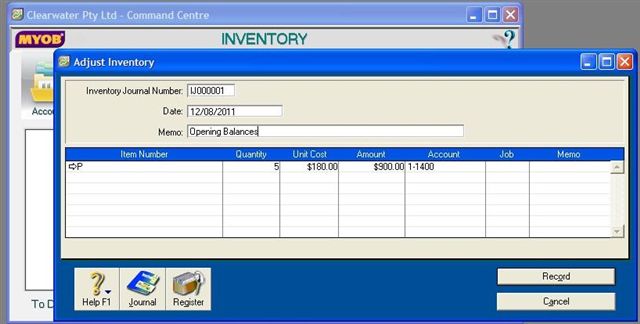

To enter the number of the items go to Count Inventory and go to the item, in the counted column enter the number then click adjust inventory. MYOB will give you a warning to be sure to enter the unit cost.

Important note: You must have a separate account for inventory adjustments – this is an asset account. Go to Accounts list and add a new account in the assets list as you will not be able to make a new account from Count Inventory.

***

Video Reference: 501407

Link for existing students: http://ezylearnonline.com.au/training/mod/resource/view.php?id=371

Receive EzyLearn news, new training materials and updates as they occur by subscribing to the blog: www.ezylearn.com.au/wordpress

For information about our Online MYOB Training Course and new Lifetime Membership for all students, please visit: www.ezylearnonline.com.au/courses/myob-training/

Please feel free to send your comments about this video to: sales@ezylearn.com.au

***